by admin / on 29 October, 2019

Florida Workers’ Comp Rates to drop 7.5 percent

Effective January 1, 2020, Florida Workers' Comp Rates for new and renewal policies for other than the "F" classifications, the statewide overall rat...

by admin / on 29 May, 2019

Fix diminishing agent commissions with Simple Work Comp

Do your commissions diminish upon renewal? If so, how big a hit will you take when your comp clients renew? 10%? 20%? 50%?

As an agent you kno...

by admin / on 22 May, 2019

Placing your work comp clients with the state fund, is it worth it?

Do the commissions justify the paper work? How to get more reward from your hard-to-place work comp clients.

Sometimes we all need to know whe...

by admin / on 31 January, 2019

Helping Agents Save Their Clients

We love opportunities to help insurance agents avoid unnecessary woes with workers' comp shopping. No matter the size of the client.

Last week...

by admin / on 17 January, 2019

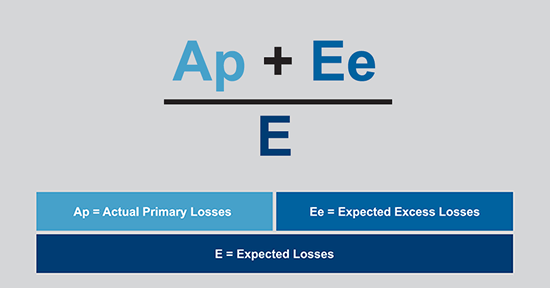

California Experience Rating

The Insurance Commissioner recently adopted changes to California experience rating (X-Mod).

Under the new California Experience Rating Plan (2019...

by admin / on 4 September, 2018

The Easiest way to keep Construction Companies in Compliance

We keep construction companies in compliance!

Get proper directions to find the solutions to stay in compliant with local, state, and federal laws...

by admin / on 16 May, 2018

Workers’ Compensation Rates will Decrease on June 1, 2018

The Florida Office of Insurance Regulation has approved a decrease of 1.8% in the rates Florida businesses pay for workers' compensation insurance.

Fl...

by admin / on 14 May, 2018

Get out from under your HIGH MOD – How to lower your MOD

Simple Work Comp has worry free solutions to help you lower your mod.

Contact us today If your business has suffered losses due to excessive claims an...

by admin / on 19 April, 2018

Helping agents with hard-to-place risk clients for over 20 years

If you're an insurance agent with hard-to-place risk clients with large losses, lapse in coverage, facing non-renewal with the inevitability of havin...

by admin / on 29 January, 2018

Georgia Workers Compensation Requirements

Frequently Asked Questions (FAQ) about Georgia Workers' Compensation Insurance

How many employees must I have in order to be required to pro