As unfavorable pricing continues, competitive market could weigh on workers’ comp

According to Fitch Ratings, workers’ compensation saw a combined ratio of 92% for the previous year. An immediate concern is the growing pressure from medical inflation, which had been somewhat tame in 2022. For the past year (ending Nov. 30, 2022), the medical consumer

FINDING THE RIGHT PEO SERVICES

A business owner’s guide to helping find the right PEO solution for their company. Download the FREE eBook today. When you are ready to make a decision, our experts will be ready to assist.

Small Business Saturday: One Business Owner to Another

Small Business Saturday is November 30th and if you are a small business owner, you obviously know about your customers and all about running your business. Business owners are our customers and we know cutting the stressful things out of our customers daily operations

Placing your work comp clients with the state fund, is it worth it?

Do the commissions justify the paper work? How to get more reward from your hard-to-place work comp clients. Sometimes we all need to know when to cut our losses and move on. However, that’s easier said than done. As a work comp insurance agent,

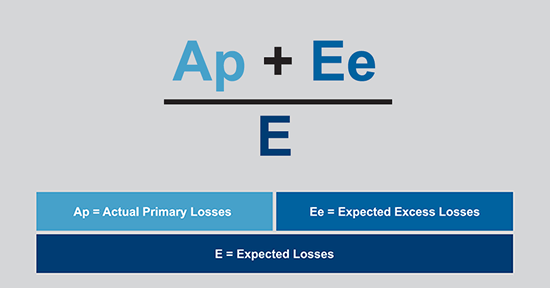

California Experience Rating

The Insurance Commissioner recently adopted changes to California experience rating (X-Mod). Under the new California Experience Rating Plan (2019) only the amount of each of your claims, up to your primary threshold, is used in the X-Mod computation. These changes make it easier for

Florida Supreme Court Ruling

Workers Compensation Rate Increase 17.1% Florida business owners may soon be paying nearly 20% more for their workers compensation coverage. In response to a recent decision from the Florida Supreme Court, the National Council on Compensation Insurance (NCCI) filed a 17.1 percent rate increase

Truckers Facing Tough Economic Times

As if the cost of fuel wasn’t taking a toll, safety concerns and rising workers comp insurance is putting an even greater dent into the earnings of truckers throughout the nation.  If you are starting a trucking company safety is going to be

HAZMAT Registration for Your Business

If you own a company that transports hazardous materials, it might be necessary to complete HAZMAT registration with the U.S. Department of Transportation. This registration is annual and will include a fee payment. Funds collected under this program go towards education and preparation for

3 Simple Things to Make Your Small Business Look Professional

Whether you have a small business that you run out of a home office or a contracting business that you run primarily out of a truck or a plumbing business where you employ 20 other plumbers and cover half the state you can make

Plumbers Plan on Problems to Protect Yourself

Most people starting a plumbing business understand that they need to follow state and local regulations when working. Sending out licensed plumbers will assure customers that all the work will be up to code and the employees will follow proper procedure. This is a