The answer is yes, and at a rapid pace.

Home insurance prices are spiking across the US responding in part to the fallout from more frequent extreme weather, which scientists attribute to climate change. Because of this, companies are raising rates and limiting coverage options.

Hundreds of smaller insurers are going out of business, unable to withstand the shock of multiple billion-dollar disasters. In states heavily hit by storms, wildfires and flooding, well-known providers have stopped accepting new policies entirely.

Companies say the upheaval reflects the huge number of claims in recent years, rising costs of repairs underlined by inflation, and growing risks in the years ahead, as climate-change induced catastrophes multiply.

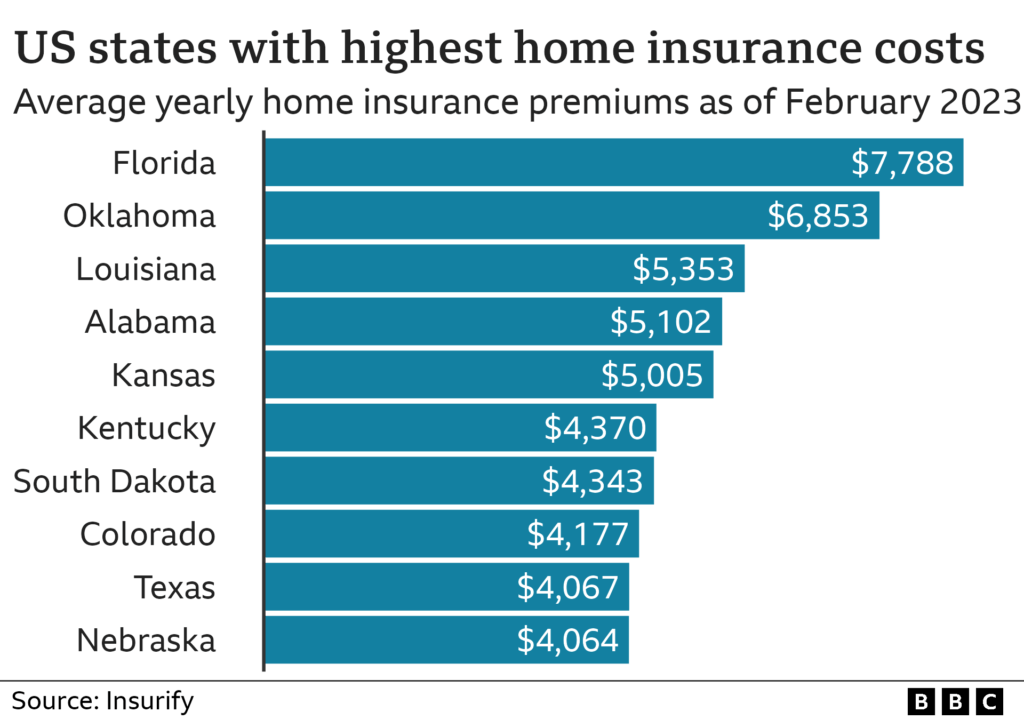

Across the nation, premiums are expected to rise 9% this year to an average of $1,784 nationally, after jumping 7% in 2022, according to Insurify, an insurance comparison site.

The increases are far larger in the most at-risk places, such as Louisiana, where Insurify estimates that home insurance costs average more than $5,000 annually, up more than 65% since 2021. The crisis has forced a dramatic expansion in state-backed plans, which are funded by taxpayers and are often some of the highest cost options.

A recent NerdWallet survey found that about 3 in 5 people with homeowners insurance say their premium has risen over the past 12 months. And around 1 in 10 are worried their insurer will stop doing business in their state.

It’s a valid concern in the US. On the east coast, like Florida, for example, private homeowners insurance has gotten so scarce that Citizens, the state-funded “insurer of last resort,” is now its top property insurer by number of policies. Our partners in California are saying the same thing. Insurance owners are seeing record-breaking numbers when it comes to insurers no longer writing policies in the Golden State.

International news sites are backing up this information, too. An article from the BBC explains how climate change worsens heatwaves, droughts, wildfires and floods. All of these changes will cause longer heatwaves, extended droughts which cause more fuel for wildfires. When did Floridians ever have to worry about Canadian wildfires that are so strong, it disrupts the beautiful air quality for beachgoers? Welcome to the present.

As insurance availability shrinks and premiums rise, the shock is expected to force a reckoning in the property market in the US, reducing demand for homes in the areas at most risk from wildfires, heat and storms – many of the same places that have experienced recent rapid growth, as movers seek out sun, jobs and more affordable housing.

How to be Proactive

If you’re having a hard time affording insurance premiums, or you’re worried your insurance company will drop you at renewal, here are 5 things you can do to stay ahead of the game:

1. Do your research

Home and auto insurance premiums can vary dramatically by company. If you think you’re paying too much, do some shopping. Gather quotes from at least three different companies to make sure you’re getting the best deal possible. This approach worked for Harlan, who ultimately found a car insurance price she’s happy with.

2. Seek assistance

If your insurance options are limited, it may be time to recruit the help of an independent insurance agent. Local agents are familiar with your area and the companies still writing policies.

3. Adjust your coverage

You can lower the cost of insurance if you’re able to assume more of the risk yourself. For example, you may be able to raise deductibles or drop optional coverages you no longer need. Just don’t reduce coverage to the point where you’d be wrecked financially if catastrophe strikes.

4. Plan before a problem occurs

Insurers periodically inspect the homes they insure (or plan to insure). This is especially true for older homes in high-risk areas. Don’t give them a reason to drop or deny you coverage. Protect your home by clearing away nearby brush or overgrown trees, and make sure your roof and electrical, plumbing and HVAC systems are in good shape.

5. Prevent insurance lapse

While it may be tempting to skip paying a high premium, letting your insurance lapse can make a bad situation worse. Not only would you be fully responsible for any damages to your home or car, but future insurers may deem you risky to insure. This will likely translate into higher premiums when you decide to get insurance again, even if you had a valid excuse for the lapse. Not to mention, insurance is required if you have a car or mortgage.

This can be a tough situation, especially if you are a new home owner. That is why the Insurance Team at Simple Work Comp is here to assist with those needs. We have over 30 years of combined experience working in Florida and affected states. Let our experts find you the best rates today!